HOME REPAIRS vs. IMPROVEMENTS: To Claim or Not to Claim, That is The Question Return to Articles

HOME REPAIRS vs. IMPROVEMENTS: To Claim or Not to Claim, That is The Question

Disclaimer: This blog may contain affiliate links .

As a homeowner you work hard to not only maintain your home, but to make renovations and improvements that will increase its value. It takes a lot of time, effort and money to keep your castle fit for your family, and at the end of the year you may be wondering, “what tax breaks can I get for all of these expenses?”

The last year was quite a ride and while many things were much different than normal, home improvements and renovations were steadily on the rise. According to a recent Home Advisor survey , in 2020 U.S. households spent an average of $8,305 on home improvements and nearly $3,200 on home repairs. With tax season upon us, it is time to make those improvements work for you.

When filing taxes, there are already a multitude of things that can be very confusing, so don’t let deciding what constitutes as a tax break when it comes to home improvements be one of them.

CAPITAL IMPROVEMENTS vs REPAIRS

Photo Credit: Tara Winstead. Review all of your home projects to determine if they are capital improvements or repairs.

How do your expenses break down at the end of the year? In regard to taxes it comes down to two categories: capital improvements or repairs .

Most repairs are not tax deductible because when fixing something that’s broken, it is usually considered basic maintenance. Two exceptions would be if repairs are made at an investment property, or in your home office. To better understand how to write off home repairs that may apply to your work space, refer to our recent blog “ 3 Requirements to Qualify Your Home office For A Tax Deduction .”

On the other hand, many capital improvements, or repairs associated with improvements are eligible for tax breaks only upon the sale of the home, if they increase the home's value, alter its uses, or materially extend its useful life , as defined by the IRS .

WHAT ARE SOME IMPROVEMENTS THAT CONSTITUTE AS TAX BREAKS?

Photo Credit: Monica Silvestre. Did you complete a major renovation in the past year?

-

Home additions, like a new bedroom or building an extension to your home

-

Remodeling a bathroom

-

Modernizing your kitchen

-

Plumbing improvements and upgrades

-

Most energy-efficient upgrades

CAPITAL GAINS TAX

While capital improvements cannot be deducted on an annual basis, like some repairs, they do add up to offset your capital gains tax when you are ready to sell. The sale of your home could be tax free if your profit is less than $250,000 for single filers or $500,000 for joint returns. If your capital gains exceeds these amounts, you could be subject to capital gains tax.

Want to minimize the amount of taxes from the sale of your home? You can increase the cost basis by itemizing fees or expenses associated with the purchase of your home. Documenting the costs associated with your home improvement projects will have the biggest impact, so make sure you know the total investment of your upgrades or renovations which will improve the value of your adjusted home basis.

RECEIPTS AND RECORDS

Once you have established which home projects qualify as a tax write off and you are ready to file, be sure to have the records and receipts for every improvement that you have done to your home on hand and easily accessible.

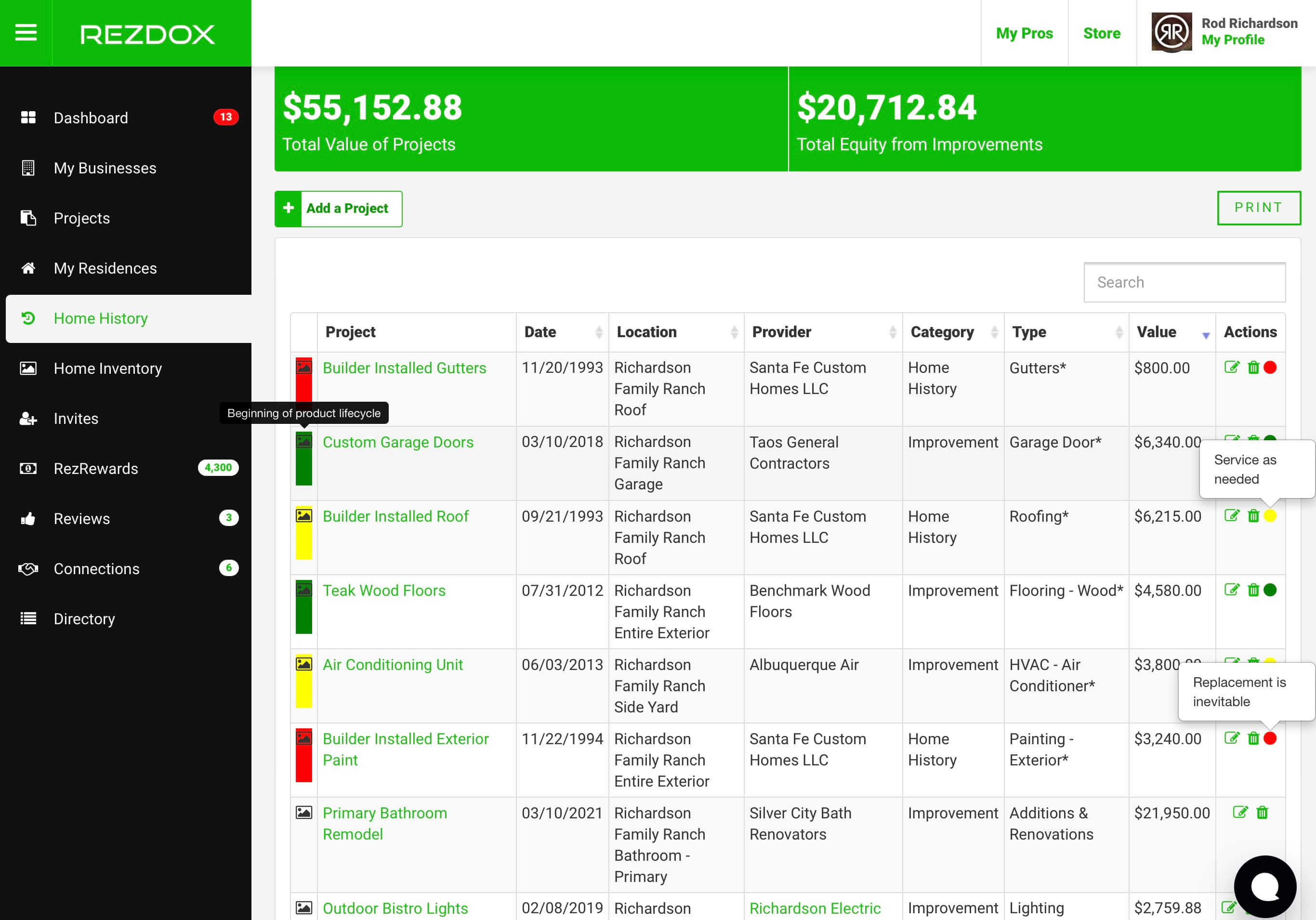

There is no specific method that is required to track your records, but those records will be required as proof of the claimed deductions. RezDox can be used to help you record and report all of your home’s repairs and improvements. You simply upload copies of invoices, receipts and photos of the project, and RezDox will digitally store them for you to conveniently access at any time.

If you are already underwater with paper records and receipts scattered about in various places throughout your home, or in that old file box stashed away in your garage, RezDox can help you digitize those and create your home history log, getting you up to date on all of the work that has been done to your home and store it all in one location.

Don’t let the money that you have spent on home improvements go to waste, unclaimed when it should be. Use those costs for your benefit and get every dollar that you are entitled to at tax time.

Remember that you are not alone in this often intimidating process, RezDox is here to help and has your back when it comes to making your home work for you.

LinnellTaylor Marketing

You may also like:

3 Requirements to Qualify Your Home Office For A Tax Deduction

Introducing RezDox RULS (Residential Useful Life Score)

The Ultimate Guide To Home Equity & Its Impact On Your Net Worth

Join our bi-monthly newsletter.

Get all of the latest insights and our exclusive content!